Implementing and estimating a simple Real Business Cycle (RBC) model(Open on Google Colab | View / download notebook | Report a problem)

This notebook collects the full example implementing and estimating (via maximum likelihood, Metropolis-Hastings, and Gibbs Sampling) a simple real business cycle model, from my working paper Estimating time series models by state space methods in Python: Statsmodels.

Table of Contents

Simple Real Business Cycle Model

This notebook contains the example code from “State Space Estimation of Time Series Models in Python: Statsmodels” for the simple RBC model.

# These are the basic import statements to get the required Python functionality

%matplotlib inline

import numpy as np

import pandas as pd

import statsmodels.api as sm

import matplotlib.pyplot as plt

Data

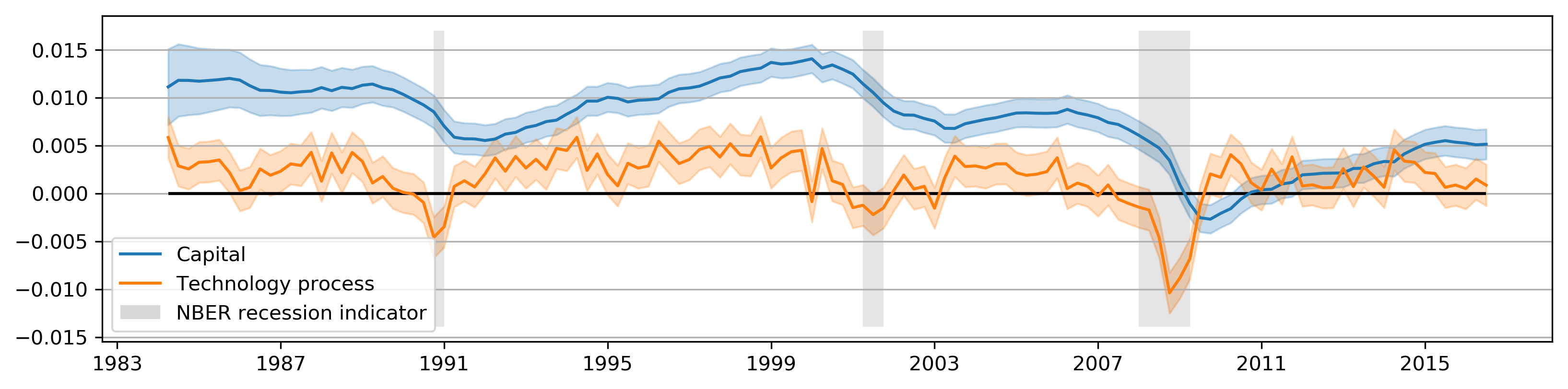

For this example, we consider an RBC model in which output, labor, and consumption are the observable series.

# RBC model

from pandas_datareader.data import DataReader

start = '1984-01'

end = '2016-09'

labor = DataReader('HOANBS', 'fred',start=start, end=end).resample('QS').first()

cons = DataReader('PCECC96', 'fred', start=start, end=end).resample('QS').first()

inv = DataReader('GPDIC1', 'fred', start=start, end=end).resample('QS').first()

pop = DataReader('CNP16OV', 'fred', start=start, end=end)

pop = pop.resample('QS').mean() # Convert pop from monthly to quarterly observations

recessions = DataReader('USRECQ', 'fred', start=start, end=end)

recessions = recessions.resample('QS').last()['USRECQ'].iloc[1:]

# Get in per-capita terms

N = labor['HOANBS'] * 6e4 / pop['CNP16OV']

C = (cons['PCECC96'] * 1e6 / pop['CNP16OV']) / 4

I = (inv['GPDIC1'] * 1e6 / pop['CNP16OV']) / 4

Y = C + I

# Log, detrend

y = np.log(Y).diff()[1:]

c = np.log(C).diff()[1:]

n = np.log(N).diff()[1:]

i = np.log(I).diff()[1:]

rbc_data = pd.concat((y, n, c), axis=1)

rbc_data.columns = ['output', 'labor', 'consumption']

# Plot the series

fig, ax = plt.subplots(figsize=(13, 3), dpi=300)

ax.plot(y.index, y, label=r'Output $(y_t)$')

ax.plot(n.index, n, label=r'Labor $(n_t)$')

ax.plot(c.index, c, label=r'Consumption $(c_t)$')

ax.yaxis.grid()

ax.legend(loc='lower left', labelspacing=0.3);

RBC Model

The simple RBC model considered here can be found in Ruge-Murcia (2007) or Dejong and Dave (2011). The non-linear system of equilibrium conditions is as follows:

\[\begin{align} \psi c_t & = (1 - \alpha) z_t \left ( \frac{k_t}{n_t} \right )^{\alpha} & \text{Static FOC} \\ \frac{1}{c_t} & = \beta E_t \left \{ \frac{1}{c_{t+1}} \left [ \alpha z_{t+1} \left ( \frac{k_{t+1}}{n_{t+1}} \right )^{\alpha - 1} + (1 - \delta) \right ] \right \} & \text{Euler equation} \\ y_t & = z_t k_t^\alpha n_t^{1 - \alpha} & \text{Production function} \\ y_t & = c_t + i_t & \text{Aggregate resource constraint} \\ k_{t+1} & = (1 - \delta) k_t + i_t & \text{Captial accumulation} \\ 1 & = l_t + n_t & \text{Labor-leisure tradeoff} \\ \log z_t & = \rho \log z_{t-1} + \varepsilon_t & \text{Technology shock transition} \end{align}\]by linearizing the model around the non-stochastic steady state, reducing the system to the three variables above, and solving with the method of Blanchard and Kahn (1980), we achieve a model in state space form.

The class SimpleRBC, below, implements the log-linearization step in the log_linearize method and the Blanchard-Kahn solution in the solve method. The params vector for that class is the vector of structural parameters:

Also, the class below has a number of parameter transformations to ensure valid parameters. For example, transform_discount_rate takes as its argument a parameter that can vary over the entire real line and transformed it to lie in the set $(0, 1)$. This can be convenient when performing maximum likelihood estimation with some numerical optimization routines.

State space form

After log-linearizing and solving the model, the resultant state space form is:

\[\begin{align} \begin{bmatrix} y_t \\ n_t \\ c_t \end{bmatrix} & = \underbrace{\begin{bmatrix} \phi_{yk} & \phi_{yz} \\ \phi_{nk} & \phi_{nz} \\ \phi_{ck} & \phi_{cz} \\ \end{bmatrix}}_{Z} \underbrace{\begin{bmatrix} k_t \\ z_t \end{bmatrix}}_{\alpha_t} + \underbrace{\begin{bmatrix} \varepsilon_{y,t} \\ \varepsilon_{n,t} \\ \varepsilon_{c,t} \end{bmatrix}}_{\varepsilon_t}, \qquad \varepsilon_t \sim N \left ( \begin{bmatrix} 0 \\ 0 \\ 0\end{bmatrix}, \begin{bmatrix} \sigma_{y}^2 & 0 & 0 \\ 0 & \sigma_{n}^2 & 0 \\ 0 & 0 & \sigma_{c}^2 \\ \end{bmatrix} \right ) \\ \begin{bmatrix} k_{t+1} \\ z_{t+1} \end{bmatrix} & = \underbrace{\begin{bmatrix} T_{kk} & T_{kz} \\ 0 & \rho \end{bmatrix}}_{T} \begin{bmatrix} k_t \\ z_t \end{bmatrix} + \underbrace{\begin{bmatrix} 0 \\ 1 \end{bmatrix}}_{R} \eta_t, \qquad \eta_t \sim N(0, \sigma_z^2) \end{align}\]where the reduced form parameters in the state space model are non-linear functions of the parameters in the RBC model, above.

The update method is called with a params vector holding the structural parameters. By log-linearizing and solving the model, those sturctural parameters are transformed into the reduced form parameters making up the state space form, and these are placed into the design, obs_cov, transition, and state_cov matrices. Then the Kalman filter and smoother can be applied to retrieve smoothed estimates of the unobserved states, compute the log-likelihood for maximum likelihood estimation, or as part of the simulation smoother for Bayesian estimation.

x = OrderedDict()

x['a'] = 1

list(x.keys()).index('a')

0

from collections import OrderedDict

class SimpleRBC(sm.tsa.statespace.MLEModel):

parameters = OrderedDict([

('discount_rate', 0.95),

('disutility_labor', 3.),

('depreciation_rate', 0.025),

('capital_share', 0.36),

('technology_shock_persistence', 0.85),

('technology_shock_var', 0.04**2)

])

def __init__(self, endog, calibrated=None):

super(SimpleRBC, self).__init__(

endog, k_states=2, k_posdef=1, initialization='stationary')

self.k_predetermined = 1

# Save the calibrated vs. estimated parameters

parameters = list(self.parameters.keys())

calibrated = calibrated or {}

self.calibrated = OrderedDict([

(param, calibrated[param]) for param in parameters

if param in calibrated

])

self.idx_calibrated = np.array([

param in self.calibrated for param in parameters])

self.idx_estimated = ~self.idx_calibrated

self.k_params = len(self.parameters)

self.k_calibrated = len(self.calibrated)

self.k_estimated = self.k_params - self.k_calibrated

self.idx_cap_share = parameters.index('capital_share')

self.idx_tech_pers = parameters.index('technology_shock_persistence')

self.idx_tech_var = parameters.index('technology_shock_var')

# Setup fixed elements of system matrices

self['selection', 1, 0] = 1

@property

def start_params(self):

structural_params = np.array(list(self.parameters.values()))[self.idx_estimated]

measurement_variances = [0.1] * 3

return np.r_[structural_params, measurement_variances]

@property

def param_names(self):

structural_params = np.array(list(self.parameters.keys()))[self.idx_estimated]

measurement_variances = ['%s.var' % name for name in self.endog_names]

return structural_params.tolist() + measurement_variances

def log_linearize(self, params):

# Extract the parameters

(discount_rate, disutility_labor, depreciation_rate, capital_share,

technology_shock_persistence, technology_shock_var) = params

# Temporary values

tmp = (1. / discount_rate - (1. - depreciation_rate))

theta = (capital_share / tmp)**(1. / (1. - capital_share))

gamma = 1. - depreciation_rate * theta**(1. - capital_share)

zeta = capital_share * discount_rate * theta**(capital_share - 1)

# Coefficient matrices from linearization

A = np.eye(2)

B11 = 1 + depreciation_rate * (gamma / (1 - gamma))

B12 = (-depreciation_rate *

(1 - capital_share + gamma * capital_share) /

(capital_share * (1 - gamma)))

B21 = 0

B22 = capital_share / (zeta + capital_share*(1 - zeta))

B = np.array([[B11, B12], [B21, B22]])

C1 = depreciation_rate / (capital_share * (1 - gamma))

C2 = (zeta * technology_shock_persistence /

(zeta + capital_share*(1 - zeta)))

C = np.array([[C1], [C2]])

return A, B, C

def solve(self, params):

capital_share = params[self.idx_cap_share]

technology_shock_persistence = params[self.idx_tech_pers]

# Get the coefficient matrices from linearization

A, B, C = self.log_linearize(params)

# Jordan decomposition of B

eigvals, right_eigvecs = np.linalg.eig(np.transpose(B))

left_eigvecs = np.transpose(right_eigvecs)

# Re-order, ascending

idx = np.argsort(eigvals)

eigvals = np.diag(eigvals[idx])

left_eigvecs = left_eigvecs[idx, :]

# Blanchard-Kahn conditions

k_nonpredetermined = self.k_states - self.k_predetermined

k_stable = len(np.where(eigvals.diagonal() < 1)[0])

k_unstable = self.k_states - k_stable

if not k_stable == self.k_predetermined:

raise RuntimeError('Blanchard-Kahn condition not met.'

' Unique solution does not exist.')

# Create partition indices

k = self.k_predetermined

p1 = np.s_[:k]

p2 = np.s_[k:]

p11 = np.s_[:k, :k]

p12 = np.s_[:k, k:]

p21 = np.s_[k:, :k]

p22 = np.s_[k:, k:]

# Decouple the system

decoupled_C = np.dot(left_eigvecs, C)

# Solve the explosive component (controls) in terms of the

# non-explosive component (states) and shocks

tmp = np.linalg.inv(left_eigvecs[p22])

# This is \phi_{ck}, above

policy_state = - np.dot(tmp, left_eigvecs[p21]).squeeze()

# This is \phi_{cz}, above

policy_shock = -(

np.dot(tmp, 1. / eigvals[p22]).dot(

np.linalg.inv(

np.eye(k_nonpredetermined) -

technology_shock_persistence / eigvals[p22]

)

).dot(decoupled_C[p2])

).squeeze()

# Solve for the non-explosive transition

# This is T_{kk}, above

transition_state = np.squeeze(B[p11] + np.dot(B[p12], policy_state))

# This is T_{kz}, above

transition_shock = np.squeeze(np.dot(B[p12], policy_shock) + C[p1])

# Create the full design matrix

tmp = (1 - capital_share) / capital_share

tmp1 = 1. / capital_share

design = np.array([[1 - tmp * policy_state, tmp1 - tmp * policy_shock],

[1 - tmp1 * policy_state, tmp1 * (1-policy_shock)],

[policy_state, policy_shock]])

# Create the transition matrix

transition = (

np.array([[transition_state, transition_shock],

[0, technology_shock_persistence]]))

return design, transition

def transform_discount_rate(self, param, untransform=False):

# Discount rate must be between 0 and 1

epsilon = 1e-4 # bound it slightly away from exactly 0 or 1

if not untransform:

return np.abs(1 / (1 + np.exp(param)) - epsilon)

else:

return np.log((1 - param + epsilon) / (param + epsilon))

def transform_disutility_labor(self, param, untransform=False):

# Disutility of labor must be positive

return param**2 if not untransform else param**0.5

def transform_depreciation_rate(self, param, untransform=False):

# Depreciation rate must be positive

return param**2 if not untransform else param**0.5

def transform_capital_share(self, param, untransform=False):

# Capital share must be between 0 and 1

epsilon = 1e-4 # bound it slightly away from exactly 0 or 1

if not untransform:

return np.abs(1 / (1 + np.exp(param)) - epsilon)

else:

return np.log((1 - param + epsilon) / (param + epsilon))

def transform_technology_shock_persistence(self, param, untransform=False):

# Persistence parameter must be between -1 and 1

if not untransform:

return param / (1 + np.abs(param))

else:

return param / (1 - param)

def transform_technology_shock_var(self, unconstrained, untransform=False):

# Variances must be positive

return unconstrained**2 if not untransform else unconstrained**0.5

def transform_params(self, unconstrained):

constrained = np.zeros(unconstrained.shape, unconstrained.dtype)

i = 0

for param in self.parameters.keys():

if param not in self.calibrated:

method = getattr(self, 'transform_%s' % param)

constrained[i] = method(unconstrained[i])

i += 1

# Measurement error variances must be positive

constrained[self.k_estimated:] = unconstrained[self.k_estimated:]**2

return constrained

def untransform_params(self, constrained):

unconstrained = np.zeros(constrained.shape, constrained.dtype)

i = 0

for param in self.parameters.keys():

if param not in self.calibrated:

method = getattr(self, 'transform_%s' % param)

unconstrained[i] = method(constrained[i], untransform=True)

i += 1

# Measurement error variances must be positive

unconstrained[self.k_estimated:] = constrained[self.k_estimated:]**0.5

return unconstrained

def update(self, params, **kwargs):

params = super(SimpleRBC, self).update(params, **kwargs)

# Reconstruct the full parameter vector from the

# estimated and calibrated parameters

structural_params = np.zeros(self.k_params, dtype=params.dtype)

structural_params[self.idx_calibrated] = list(self.calibrated.values())

structural_params[self.idx_estimated] = params[:self.k_estimated]

measurement_variances = params[self.k_estimated:]

# Solve the model

design, transition = self.solve(structural_params)

# Update the statespace representation

self['design'] = design

self['obs_cov', 0, 0] = measurement_variances[0]

self['obs_cov', 1, 1] = measurement_variances[1]

self['obs_cov', 2, 2] = measurement_variances[2]

self['transition'] = transition

self['state_cov', 0, 0] = structural_params[self.idx_tech_var]

Calibration / Maximum likelihood estimation

It is sometimes interesting to calibrate the structural parameters of the model, and estimate only the measurement error variables.

# Calibrate everything except measurement variances

calibrated = {

'discount_rate': 0.95,

'disutility_labor': 3.0,

'capital_share': 0.36,

'depreciation_rate': 0.025,

'technology_shock_persistence': 0.85,

'technology_shock_var': 0.04**2

}

calibrated_mod = SimpleRBC(rbc_data, calibrated=calibrated)

calibrated_res = calibrated_mod.fit(method='nm', maxiter=1000, disp=0)

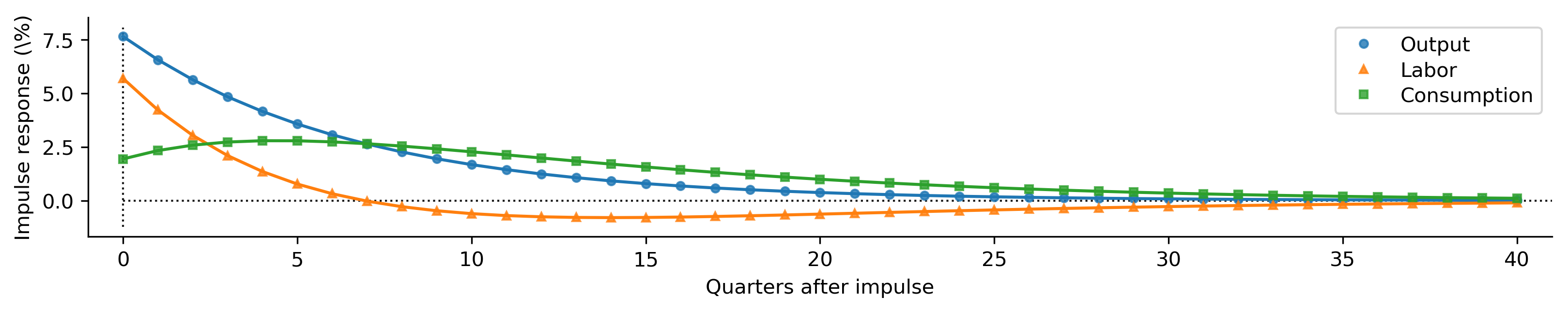

calibrated_irfs = calibrated_res.impulse_responses(40, orthogonalized=True) * 100

print(calibrated_res.summary())

Statespace Model Results

==============================================================================================

Dep. Variable: ['output', 'labor', 'consumption'] No. Observations: 130

Model: SimpleRBC Log Likelihood 1226.745

Date: Thu, 01 Nov 2018 AIC -2447.489

Time: 20:35:50 BIC -2438.887

Sample: 04-01-1984 HQIC -2443.994

- 07-01-2016

Covariance Type: opg

===================================================================================

coef std err z P>|z| [0.025 0.975]

-----------------------------------------------------------------------------------

output.var 6.449e-10 6.12e-06 0.000 1.000 -1.2e-05 1.2e-05

labor.var 3.783e-05 4.18e-06 9.054 0.000 2.96e-05 4.6e-05

consumption.var 1.462e-05 1.79e-06 8.166 0.000 1.11e-05 1.81e-05

=====================================================================================

Ljung-Box (Q): 46.67, 140.06, 52.77 Jarque-Bera (JB): 6.89, 13.51, 7.85

Prob(Q): 0.22, 0.00, 0.09 Prob(JB): 0.03, 0.00, 0.02

Heteroskedasticity (H): 1.24, 1.14, 0.47 Skew: -0.08, -0.61, 0.53

Prob(H) (two-sided): 0.48, 0.66, 0.02 Kurtosis: 4.12, 3.99, 3.59

=====================================================================================

Warnings:

[1] Covariance matrix calculated using the outer product of gradients (complex-step).

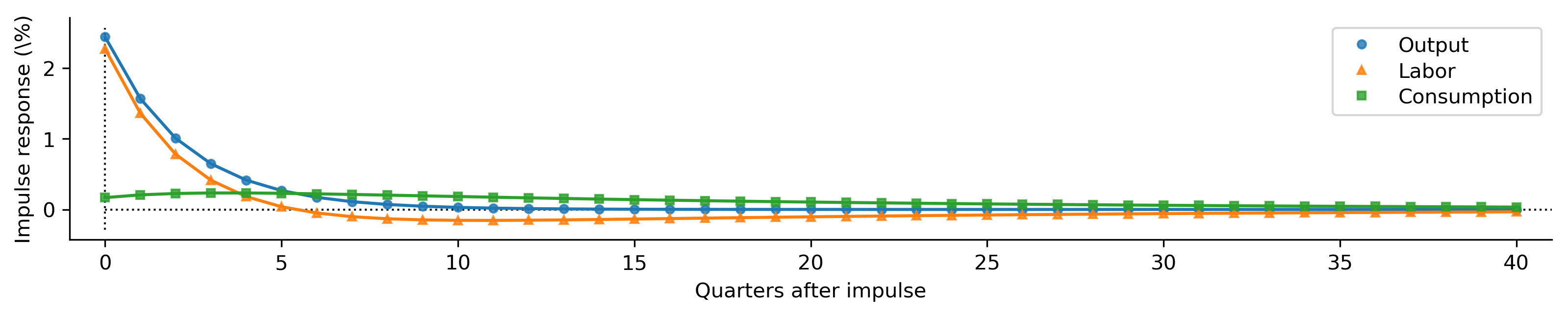

Output plots

Because we’re going to be making the same plots for a couple of examples, we define a function here to do that for us.

from scipy.stats import norm

def plot_irfs(irfs):

fig, ax = plt.subplots(figsize=(13, 2), dpi=300)

lines, = ax.plot(irfs['output'], label='')

ax.plot(irfs['output'], 'o', label='Output', color=lines.get_color(),

markersize=4, alpha=0.8)

lines, = ax.plot(irfs['labor'], label='')

ax.plot(irfs['labor'], '^', label='Labor', color=lines.get_color(),

markersize=4, alpha=0.8)

lines, = ax.plot(irfs['consumption'], label='')

ax.plot(irfs['consumption'], 's', label='Consumption',

color=lines.get_color(), markersize=4, alpha=0.8)

ax.hlines(0, 0, irfs.shape[0], alpha=0.9, linestyle=':', linewidth=1)

ylim = ax.get_ylim()

ax.vlines(0, ylim[0]+1e-6, ylim[1]-1e-6, alpha=0.9, linestyle=':',

linewidth=1)

[ax.spines[spine].set(linewidth=0) for spine in ['top', 'right']]

ax.set(xlabel='Quarters after impulse', ylabel='Impulse response (\%)',

xlim=(-1, len(irfs)))

ax.legend(labelspacing=0.3)

return fig

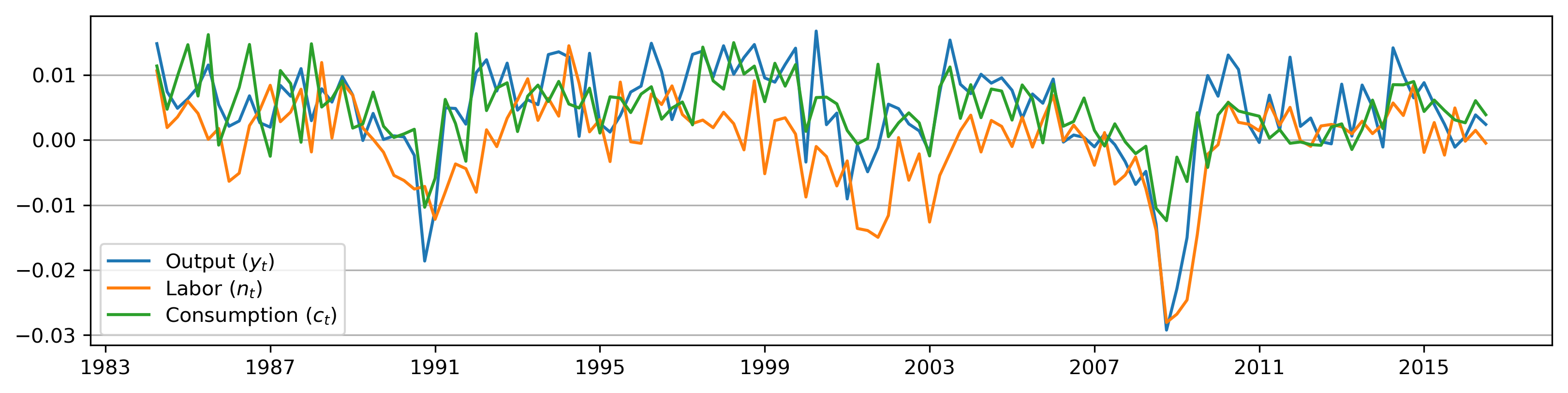

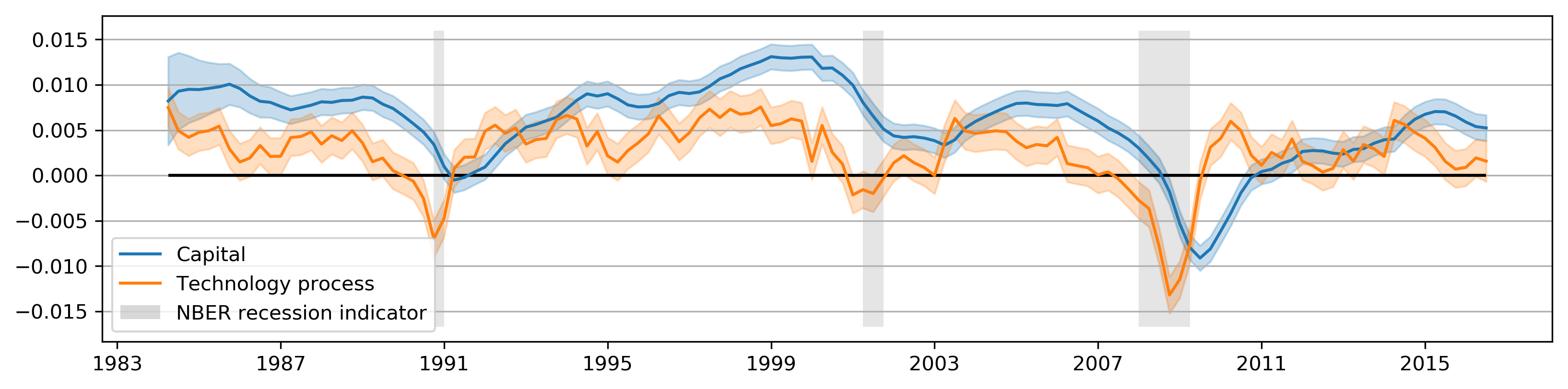

def plot_states(res):

fig, ax = plt.subplots(figsize=(13, 3), dpi=300)

alpha = 0.1

q = norm.ppf(1 - alpha / 2)

capital = res.smoothed_state[0, :]

capital_se = res.smoothed_state_cov[0, 0, :]**0.5

capital_lower = capital - capital_se * q

capital_upper = capital + capital_se * q

shock = res.smoothed_state[1, :]

shock_se = res.smoothed_state_cov[1, 1, :]**0.5

shock_lower = shock - shock_se * q

shock_upper = shock + shock_se * q

line_capital, = ax.plot(rbc_data.index, capital, label='Capital')

ax.fill_between(rbc_data.index, capital_lower, capital_upper, alpha=0.25,

color=line_capital.get_color())

line_shock, = ax.plot(rbc_data.index, shock, label='Technology process')

ax.fill_between(rbc_data.index, shock_lower, shock_upper, alpha=0.25,

color=line_shock.get_color())

ax.hlines(0, rbc_data.index[0], rbc_data.index[-1], 'k')

ax.yaxis.grid()

ylim = ax.get_ylim()

ax.fill_between(recessions.index, ylim[0]+1e-5, ylim[1]-1e-5, recessions,

facecolor='k', alpha=0.1)

p1 = plt.Rectangle((0, 0), 1, 1, fc="grey", alpha=0.3)

ax.legend([line_capital, line_shock, p1],

["Capital", "Technology process", "NBER recession indicator"],

loc='lower left');

return fig

plot_states(calibrated_res);

plot_irfs(calibrated_irfs);

Maximum likelihood estimation

We can try to estimate more parameters.

# Now, don't calibrate the technology parameters

partially_calibrated = {

'discount_rate': 0.95,

'disutility_labor': 3.0,

'capital_share': 0.33,

'depreciation_rate': 0.025,

}

partial_mod = SimpleRBC(rbc_data, calibrated=partially_calibrated)

partial_res = partial_mod.fit(method='nm', maxiter=1000, disp=0)

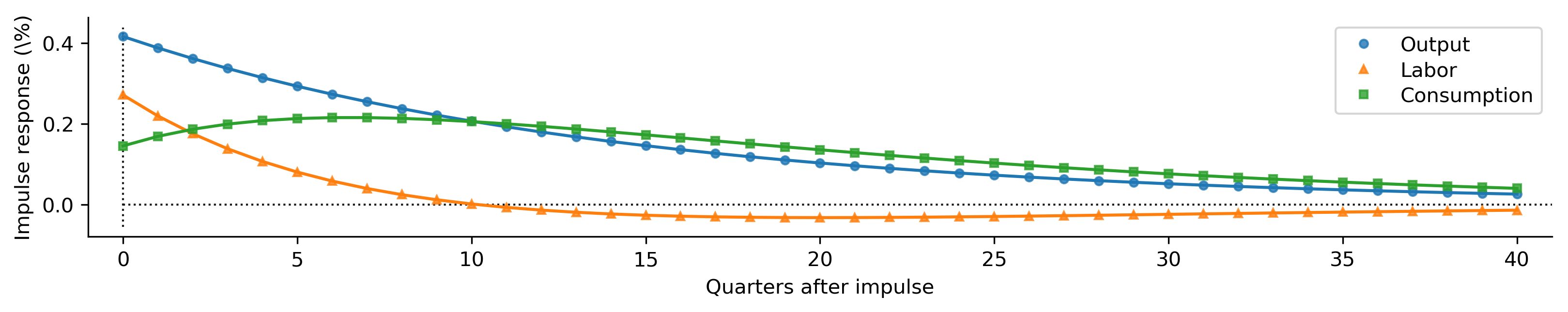

partial_irfs = partial_res.impulse_responses(40, orthogonalized=True) * 100

print(partial_res.summary())

Statespace Model Results

==============================================================================================

Dep. Variable: ['output', 'labor', 'consumption'] No. Observations: 130

Model: SimpleRBC Log Likelihood 1501.123

Date: Thu, 01 Nov 2018 AIC -2992.246

Time: 20:35:53 BIC -2977.908

Sample: 04-01-1984 HQIC -2986.420

- 07-01-2016

Covariance Type: opg

================================================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------------------------

technology_shock_persistence 0.9329 0.023 40.397 0.000 0.888 0.978

technology_shock_var 5.491e-06 1.04e-06 5.277 0.000 3.45e-06 7.53e-06

output.var 9.967e-06 2.67e-06 3.731 0.000 4.73e-06 1.52e-05

labor.var 3.33e-05 4.31e-06 7.730 0.000 2.49e-05 4.17e-05

consumption.var 1.444e-05 1.64e-06 8.817 0.000 1.12e-05 1.77e-05

======================================================================================

Ljung-Box (Q): 35.57, 193.85, 53.19 Jarque-Bera (JB): 12.25, 11.14, 16.40

Prob(Q): 0.67, 0.00, 0.08 Prob(JB): 0.00, 0.00, 0.00

Heteroskedasticity (H): 1.36, 1.19, 0.50 Skew: 0.14, -0.61, 0.69

Prob(H) (two-sided): 0.31, 0.58, 0.03 Kurtosis: 4.48, 3.75, 4.07

======================================================================================

Warnings:

[1] Covariance matrix calculated using the outer product of gradients (complex-step).

plot_states(partial_res);

plot_irfs(partial_irfs);

Metropolis-within-Gibbs Sampling

def draw_posterior_rho(model, states, sigma2, truncate=False):

Z = states[1:2, 1:]

X = states[1:2, :-1]

tmp = 1 / (sigma2 + np.sum(X**2))

post_mean = tmp * np.squeeze(np.dot(X, Z.T))

post_var = tmp * sigma2

if truncate:

lower = (-1 - post_mean) / post_var**0.5

upper = (1 - post_mean) / post_var**0.5

rvs = truncnorm.rvs(lower, upper, loc=post_mean, scale=post_var**0.5)

else:

rvs = norm.rvs(post_mean, post_var**0.5)

return rvs

def draw_posterior_sigma2(model, states, rho):

resid = states[1, 1:] - rho * states[1, :-1]

post_shape = 2.00005 + model.nobs

post_scale = 0.0100005 + np.sum(resid**2)

return invgamma.rvs(post_shape, scale=post_scale)

np.set_printoptions(suppress=True)

np.random.seed(17429)

from statsmodels.tsa.statespace.tools import is_invertible

from scipy.stats import multivariate_normal, gamma, invgamma, beta, uniform

# Create the model for likelihood evaluation

calibrated = {

'disutility_labor': 3.0,

'depreciation_rate': 0.025,

}

model = SimpleRBC(rbc_data, calibrated=calibrated)

sim_smoother = model.simulation_smoother()

# Specify priors

prior_discount = gamma(6.25, scale=0.04)

prior_cap_share = norm(0.3, scale=0.01)

prior_meas_err = invgamma(2.0025, scale=0.10025)

# Proposals

rw_discount = norm(scale=0.3)

rw_cap_share = norm(scale=0.01)

rw_meas_err = norm(scale=0.003)

# Create storage arrays for the traces

n_iterations = 10000

trace = np.zeros((n_iterations + 1, 7))

trace_accepts = np.zeros((n_iterations, 5))

trace[0] = model.start_params

trace[0, 0] = 100 * ((1 / trace[0, 0]) - 1)

loglike = None

# Iterations

for s in range(1, n_iterations + 1):

if s % 1000 == 0:

print(s)

# Get the parameters from the trace

discount_rate = 1 / (1 + (trace[s-1, 0] / 100))

capital_share = trace[s-1, 1]

rho = trace[s-1, 2]

sigma2 = trace[s-1, 3]

meas_vars = trace[s-1, 4:]**2

# 1. Gibbs step: draw the states using the simulation smoother

model.update(np.r_[discount_rate, capital_share, rho, sigma2, meas_vars])

sim_smoother.simulate()

states = sim_smoother.simulated_state[:, :-1]

# 2. Gibbs step: draw the autoregressive parameter, and apply

# rejection sampling to ensure an invertible lag polynomial

# In rare cases due to the combinations of other parameters,

# the mean of the normal posterior will be greater than one

# and it becomes difficult to draw from a normal distribution

# even with rejection sampling. In those cases we draw from a

# truncated normal.

rho = draw_posterior_rho(model, states, sigma2)

i = 0

while rho < -1 or rho > 1:

if i < 1e2:

rho = draw_posterior_rho(model, states, sigma2)

else:

rho = draw_posterior_rho(model, states, sigma2, truncate=True)

i += 1

trace[s, 2] = rho

# 3. Gibbs step: draw the variance parameter

sigma2 = draw_posterior_sigma2(model, states, rho)

trace[s, 3] = sigma2

# Calculate the loglikelihood

loglike = model.loglike(np.r_[discount_rate, capital_share, rho, sigma2, meas_vars])

# 4. Metropolis-step for the discount rate

discount_param = trace[s-1, 0]

proposal_param = discount_param + rw_discount.rvs()

proposal_rate = 1 / (1 + (proposal_param / 100))

if proposal_rate < 1:

proposal_loglike = model.loglike(np.r_[proposal_rate, capital_share, rho, sigma2, meas_vars])

acceptance_probability = np.exp(

proposal_loglike - loglike +

prior_discount.logpdf(proposal_param) -

prior_discount.logpdf(discount_param))

if acceptance_probability > uniform.rvs():

discount_param = proposal_param

discount_rate = proposal_rate

loglike = proposal_loglike

trace_accepts[s-1, 0] = 1

trace[s, 0] = discount_param

# 5. Metropolis-step for the capital-share

proposal = capital_share + rw_cap_share.rvs()

if proposal > 0 and proposal < 1:

proposal_loglike = model.loglike(np.r_[discount_rate, proposal, rho, sigma2, meas_vars])

acceptance_probability = np.exp(

proposal_loglike - loglike +

prior_cap_share.logpdf(proposal) -

prior_cap_share.logpdf(capital_share))

if acceptance_probability > uniform.rvs():

capital_share = proposal

trace_accepts[s-1, 1] = 1

loglike = proposal_loglike

trace[s, 1] = capital_share

# 6. Metropolis-step for the measurement errors

for i in range(3):

meas_std = meas_vars[i]**0.5

proposal = meas_std + rw_meas_err.rvs()

proposal_vars = meas_vars.copy()

proposal_vars[i] = proposal**2

if proposal > 0:

proposal_loglike = model.loglike(np.r_[discount_rate, capital_share, rho, sigma2, proposal_vars])

acceptance_probability = np.exp(

proposal_loglike - loglike +

prior_meas_err.logpdf(proposal) -

prior_meas_err.logpdf(meas_std))

if acceptance_probability > uniform.rvs():

meas_std = proposal

trace_accepts[s-1, 2+i] = 1

loglike = proposal_loglike

meas_vars[i] = proposal_vars[i]

trace[s, 4+i] = meas_std

1000

2000

3000

4000

5000

6000

7000

8000

9000

10000

from scipy.stats import gaussian_kde

burn = 1000

thin = 10

final_trace = trace.copy()

final_trace = final_trace[burn:][::thin]

final_trace[:, 0] = 1 / (1 + (final_trace[:, 0] / 100))

final_trace[:, 4:] = final_trace[:, 4:]**2

modes = np.zeros(7)

means = np.mean(final_trace, axis=0)

discount_kde = gaussian_kde(final_trace[:, 0])

cap_share_kde = gaussian_kde(final_trace[:, 1])

rho_kde = gaussian_kde(final_trace[:, 2])

sigma2_kde = gaussian_kde(final_trace[:, 3])

# Finish calculating modes

for i in range(7):

kde = gaussian_kde(final_trace[:, i])

X = np.linspace(np.min(final_trace[:, i]),

np.max(final_trace[:, i]), 1000)

Y = kde(X)

modes[i] = X[np.argmax(Y)]

test = pd.DataFrame(final_trace)

print(pd.DataFrame(

np.c_[modes, means, test.quantile(q=0.05), test.quantile(q=0.95)],

columns=['Mode', 'Mean', '5 percent', '95 percent']

).to_string(float_format=lambda x: '%.3g' % x))

Mode Mean 5 percent 95 percent

0 0.997 0.996 0.994 0.998

1 0.33 0.327 0.311 0.344

2 0.674 0.625 0.263 0.927

3 8.21e-05 8.34e-05 7.12e-05 9.75e-05

4 2e-05 2.07e-05 1.37e-05 2.97e-05

5 2.83e-05 2.95e-05 2.05e-05 4e-05

6 2.27e-05 2.38e-05 1.81e-05 3.01e-05

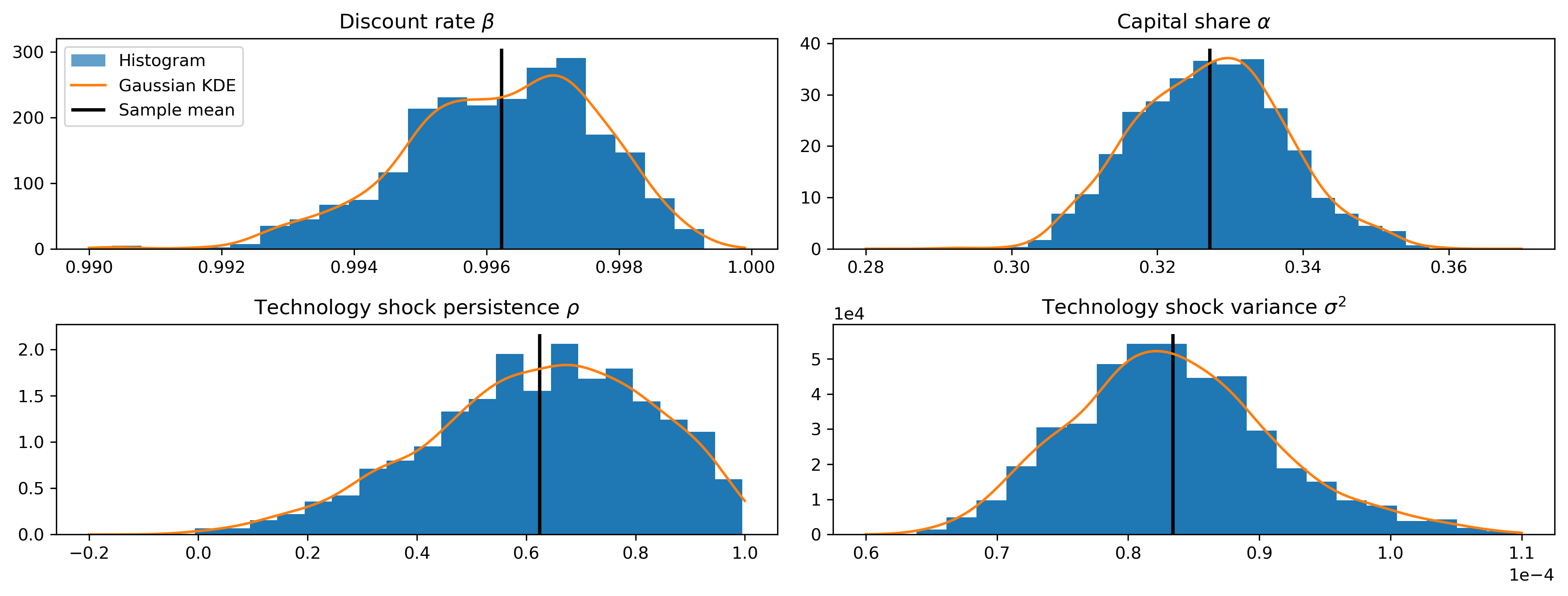

Sampler output

# Trace plots

fig, axes = plt.subplots(2, 2, figsize=(13, 5), dpi=300)

axes[0, 0].hist(final_trace[:, 0], bins=20, density=True, alpha=1)

X = np.linspace(0.990, 1.0-1e-4, 1000)

Y = discount_kde(X)

modes[0] = X[np.argmax(Y)]

line, = axes[0, 0].plot(X, Y)

ylim = axes[0, 0].get_ylim()

vline = axes[0, 0].vlines(means[0], ylim[0], ylim[1], linewidth=2)

axes[0, 0].set(title=r'Discount rate $\beta$')

axes[0, 1].hist(final_trace[:, 1], bins=20, density=True, alpha=1)

X = np.linspace(0.280, 0.370, 1000)

Y = cap_share_kde(X)

modes[1] = X[np.argmax(Y)]

axes[0, 1].plot(X, Y)

ylim = axes[0, 1].get_ylim()

vline = axes[0, 1].vlines(means[1], ylim[0], ylim[1], linewidth=2)

axes[0, 1].set(title=r'Capital share $\alpha$')

axes[1, 0].hist(final_trace[:, 2], bins=20, density=True, alpha=1)

X = np.linspace(-0.2, 1-1e-4, 1000)

Y = rho_kde(X)

modes[2] = X[np.argmax(Y)]

axes[1, 0].plot(X, Y)

ylim = axes[1, 0].get_ylim()

vline = axes[1, 0].vlines(means[2], ylim[0], ylim[1], linewidth=2)

axes[1, 0].set(title=r'Technology shock persistence $\rho$')

axes[1, 1].hist(final_trace[:, 3], bins=20, density=True, alpha=1)

X = np.linspace(0.6e-4, 1.1e-4, 1000)

Y = sigma2_kde(X)

modes[3] = X[np.argmax(Y)]

axes[1, 1].plot(X, Y)

ylim = axes[1, 1].get_ylim()

vline = axes[1, 1].vlines(means[3], ylim[0], ylim[1], linewidth=2)

axes[1, 1].ticklabel_format(style='sci', scilimits=(-2, 2))

axes[1, 1].set(title=r'Technology shock variance $\sigma^2$')

p1 = plt.Rectangle((0, 0), 1, 1, alpha=0.7)

axes[0, 0].legend([p1, line, vline],

["Histogram", "Gaussian KDE", "Sample mean"],

loc='upper left')

fig.tight_layout()

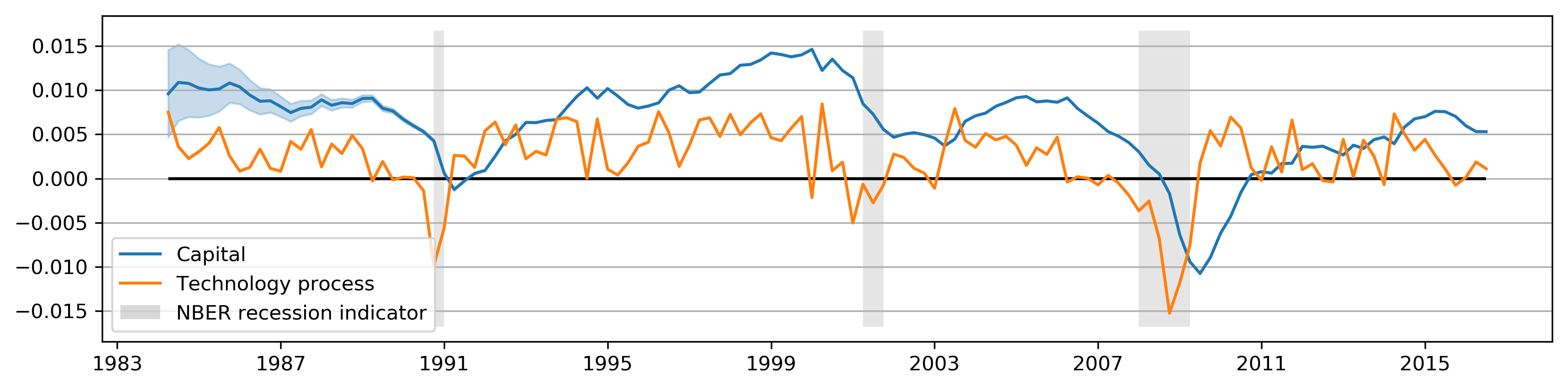

Model of the posterior median

One way to explore the implications of the posterior is to example the model at the posterior mean or median.

gibbs_res = model.smooth(np.median(final_trace, axis=0))

print(gibbs_res.summary())

gibbs_irfs = gibbs_res.impulse_responses(40, orthogonalized=True)*100

Statespace Model Results

==============================================================================================

Dep. Variable: ['output', 'labor', 'consumption'] No. Observations: 130

Model: SimpleRBC Log Likelihood 1353.026

Date: Thu, 01 Nov 2018 AIC -2692.052

Time: 20:38:30 BIC -2671.979

Sample: 04-01-1984 HQIC -2683.895

- 07-01-2016

Covariance Type: opg

================================================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------------------------

discount_rate 0.9963 0.008 118.930 0.000 0.980 1.013

capital_share 0.3274 0.179 1.833 0.067 -0.023 0.677

technology_shock_persistence 0.6423 0.390 1.648 0.099 -0.122 1.406

technology_shock_var 8.303e-05 7.43e-05 1.117 0.264 -6.27e-05 0.000

output.var 2.017e-05 2.09e-05 0.964 0.335 -2.08e-05 6.12e-05

labor.var 2.909e-05 1.85e-05 1.570 0.116 -7.22e-06 6.54e-05

consumption.var 2.363e-05 4.14e-06 5.704 0.000 1.55e-05 3.18e-05

=====================================================================================

Ljung-Box (Q): 35.26, 72.73, 58.06 Jarque-Bera (JB): 16.34, 0.66, 2.89

Prob(Q): 0.68, 0.00, 0.03 Prob(JB): 0.00, 0.72, 0.24

Heteroskedasticity (H): 1.25, 0.83, 0.58 Skew: -0.32, -0.11, -0.24

Prob(H) (two-sided): 0.47, 0.54, 0.08 Kurtosis: 4.62, 3.28, 3.55

=====================================================================================

Warnings:

[1] Covariance matrix calculated using the outer product of gradients (complex-step).

plot_states(gibbs_res);

plot_irfs(gibbs_irfs);