Markov-Switching - Kim, Nelson, and Startz (1998) Three-state Variance Switching(Open on Google Colab | View / download notebook | Report a problem)

Deprecation - this notebook has been superseded by "Markov switching autoregression models".

Table of Contents

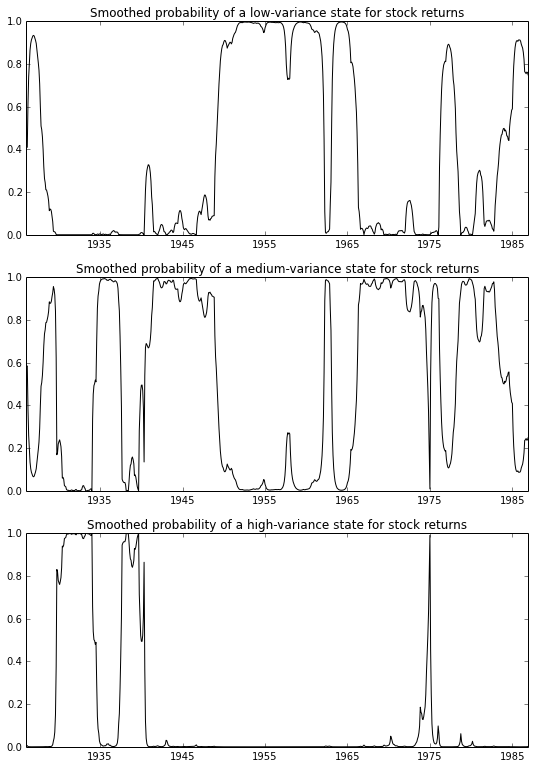

This gives an example of the use of the Markov Switching Model that I wrote for the Statsmodels Python package, to replicate the treatment of Kim, Nelson, and Startz (1998) as given in Kim and Nelson (1999). This model demonstrates estimation with regime heteroskedasticity (switching of variances) and fixed means (all at zero).

This is tested against Kim and Nelson’s (1999) code (STCK_V3.OPT), which can be found at http://econ.korea.ac.kr/~cjkim/SSMARKOV.htm. It also corresponds to the examples of Markov-switching models from E-views 8, which can be found at http://www.eviews.com/EViews8/ev8ecswitch_n.html#RegHet.

import numpy as np

import pandas as pd

import statsmodels.api as sm

from statsmodels.tsa.mar_model import MAR

# Model Setup

order = 0

nstates = 3

switch_ar = False

switch_var = True

switch_mean = [0,0,0]

# Equal-Weighted Excess Returns

f = open('data/ew_excs.prn')

data = pd.DataFrame(

[float(line.strip()) for line in f.readlines()[:-3]],

# Not positive these are the right dates...

index=pd.date_range('1926-01-01', '1995-10-01', freq='MS'),

columns=['ewer']

)

data = data[0:732]

data['dmewer'] = data['ewer'] - data['ewer'].mean()

mod = MAR(data.dmewer, 0, nstates,

switch_ar=switch_ar, switch_var=switch_var, switch_mean=switch_mean)

params = np.array([

16.399767, 12.791361, 0.522758, 4.417225, -5.845336, -3.028234,

6.704260/2, 5.520378/2, 3.473059/2

])

# Filter the data

(

marginal_densities, filtered_joint_probabilities,

filtered_joint_probabilities_t1

) = mod.filter(params);

transitions = mod.separate_params(params)[0]

# Smooth the data

filtered_marginal_probabilities = mod.marginalize_probabilities(filtered_joint_probabilities[1:])

smoothed_marginal_probabilities = mod.smooth(filtered_joint_probabilities, filtered_joint_probabilities_t1, transitions)

# Save the data

data['smoothed_low'] = np.r_[

[np.NaN]*order,

smoothed_marginal_probabilities[:,0]

]

data['smoothed_medium'] = np.r_[

[np.NaN]*order,

smoothed_marginal_probabilities[:,1]

]

data['smoothed_high'] = np.r_[

[np.NaN]*order,

smoothed_marginal_probabilities[:,2]

]

import matplotlib.pyplot as plt

from matplotlib import dates

fig = plt.figure(figsize=(9,13))

ax = fig.add_subplot(311)

ax.plot(data.index, data.smoothed_low, 'k')

ax.set(

xlim=('1926-01-01', '1986-12-01'),

ylim=(0,1),

title='Smoothed probability of a low-variance state for stock returns'

);

ax = fig.add_subplot(312)

ax.plot(data.index, data.smoothed_medium, 'k')

ax.set(

xlim=('1926-01-01', '1986-12-01'),

ylim=(0,1),

title='Smoothed probability of a medium-variance state for stock returns'

);

ax = fig.add_subplot(313)

ax.plot(data.index, data.smoothed_high, 'k')

ax.set(

xlim=('1926-01-01', '1986-12-01'),

ylim=(0,1),

title='Smoothed probability of a high-variance state for stock returns'

);