Implementing and estimating an ARMA(1, 1) state space model(Open on Google Colab | View / download notebook | Report a problem)

This notebook collects the full example implementing and estimating (via maximum likelihood, Metropolis-Hastings, and Gibbs Sampling) a specific autoregressive integrated moving average (ARIMA) model, from my working paper Estimating time series models by state space methods in Python: Statsmodels.

Table of Contents

ARMA(1, 1) - CPI Inflation

This notebook contains the example code from “State Space Estimation of Time Series Models in Python: Statsmodels” for the ARMA(1, 1) model of CPI inflation.

# These are the basic import statements to get the required Python functionality

%matplotlib inline

import numpy as np

import pandas as pd

import statsmodels.api as sm

import matplotlib.pyplot as plt

Data

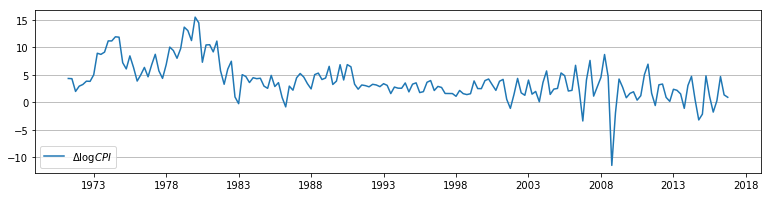

For this example, we consider modeling quarterly CPI inflation. Below, we retrieve the data directly from the Federal Reserve Economic Database using the pandas_datareader package.

# Get the data from FRED

from pandas_datareader.data import DataReader

cpi = DataReader('CPIAUCNS', 'fred', start='1971-01', end='2016-12')

cpi.index = pd.DatetimeIndex(cpi.index, freq='MS')

inf = np.log(cpi).resample('QS').mean().diff()[1:] * 400

# Plot the series to see what it looks like

fig, ax = plt.subplots(figsize=(13, 3), dpi=300)

ax.plot(inf.index, inf, label=r'$\Delta \log CPI$')

ax.legend(loc='lower left')

ax.yaxis.grid();

State space model

The ARMA(1, 1) model is:

\[y_t = \phi y_{t-1} + \varepsilon_t + \theta_1 \varepsilon_{t-1}, \qquad \varepsilon_t \sim N(0, \sigma^2)\]and it can be written in state-space form as:

\[\begin{align} y_t & = \underbrace{\begin{bmatrix} 1 & \theta_1 \end{bmatrix}}_{Z} \underbrace{\begin{bmatrix} \alpha_{1,t} \\ \alpha_{2,t} \end{bmatrix}}_{\alpha_t} \\ \begin{bmatrix} \alpha_{1,t+1} \\ \alpha_{2,t+1} \end{bmatrix} & = \underbrace{\begin{bmatrix} \phi & 0 \\ 1 & 0 \\ \end{bmatrix}}_{T} \begin{bmatrix} \alpha_{1,t} \\ \alpha_{2,t} \end{bmatrix} + \underbrace{\begin{bmatrix} 1 \\ 0 \end{bmatrix}}_{R} \underbrace{\varepsilon_{t+1}}_{\eta_t} \\ \end{align}\]Below we construct a custom class, ARMA11, to estimate the ARMA(1, 1) model.

from statsmodels.tsa.statespace.tools import (constrain_stationary_univariate,

unconstrain_stationary_univariate)

class ARMA11(sm.tsa.statespace.MLEModel):

start_params = [0, 0, 1]

param_names = ['phi', 'theta', 'sigma2']

def __init__(self, endog):

super(ARMA11, self).__init__(

endog, k_states=2, k_posdef=1, initialization='stationary')

self['design', 0, 0] = 1.

self['transition', 1, 0] = 1.

self['selection', 0, 0] = 1.

def transform_params(self, params):

phi = constrain_stationary_univariate(params[0:1])

theta = constrain_stationary_univariate(params[1:2])

sigma2 = params[2]**2

return np.r_[phi, theta, sigma2]

def untransform_params(self, params):

phi = unconstrain_stationary_univariate(params[0:1])

theta = unconstrain_stationary_univariate(params[1:2])

sigma2 = params[2]**0.5

return np.r_[phi, theta, sigma2]

def update(self, params, **kwargs):

# Transform the parameters if they are not yet transformed

params = super(ARMA11, self).update(params, **kwargs)

self['design', 0, 1] = params[1]

self['transition', 0, 0] = params[0]

self['state_cov', 0, 0] = params[2]

Maximum likelihood estimation

With this class, we can instantiate a new object with the inflation data and fit the model by maximum likelihood methods.

inf_model = ARMA11(inf)

inf_results = inf_model.fit()

print(inf_results.summary())

Statespace Model Results

==============================================================================

Dep. Variable: CPIAUCNS No. Observations: 183

Model: ARMA11 Log Likelihood -432.375

Date: Sat, 28 Jan 2017 AIC 870.750

Time: 09:34:31 BIC 880.379

Sample: 04-01-1971 HQIC 874.653

- 10-01-2016

Covariance Type: opg

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

phi 0.9784 0.016 62.713 0.000 0.948 1.009

theta -0.6338 0.059 -10.750 0.000 -0.749 -0.518

sigma2 6.5407 0.342 19.145 0.000 5.871 7.210

===================================================================================

Ljung-Box (Q): 258.37 Jarque-Bera (JB): 653.28

Prob(Q): 0.00 Prob(JB): 0.00

Heteroskedasticity (H): 1.77 Skew: -1.48

Prob(H) (two-sided): 0.03 Kurtosis: 11.77

===================================================================================

Warnings:

[1] Covariance matrix calculated using the outer product of gradients (complex-step).

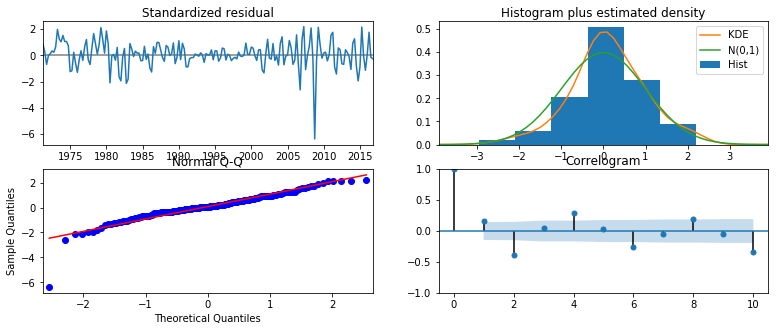

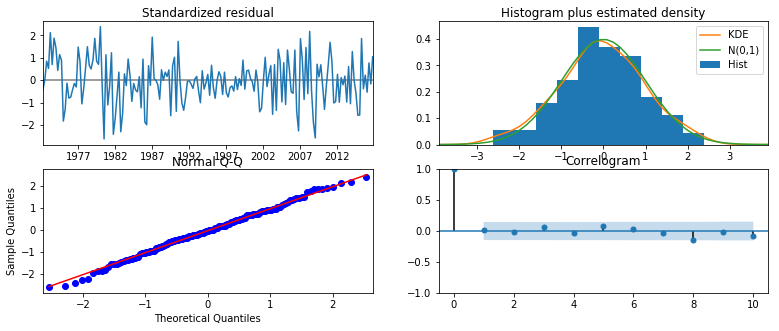

Notice that the diagnostic tests reported in the lower table suggest that our residuals do not appear to be white noise - in particular, we can reject at the 5% level the null hypotheses of serial independence (Ljung-Box test), homoskedasticity (Heteroskedasticity test), and normality (Jarque-Bera test).

To further investicate the residuals, we can produce diagnostic plots.

inf_results.plot_diagnostics(figsize=(13, 5));

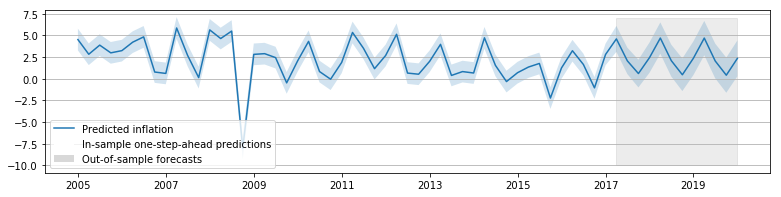

We can also produce in-sample one-step-ahead predictions and out-of-sample forecasts:

# Construct the predictions / forecasts

inf_forecast = inf_results.get_prediction(start='2005-01-01', end='2020-01-01')

# Plot them

fig, ax = plt.subplots(figsize=(13, 3), dpi=300)

forecast = inf_forecast.predicted_mean

ci = inf_forecast.conf_int(alpha=0.5)

ax.fill_between(forecast.ix['2017-01-02':].index, -3, 7, color='grey',

alpha=0.15)

lines, = ax.plot(forecast.index, forecast)

ax.fill_between(forecast.index, ci['lower CPIAUCNS'], ci['upper CPIAUCNS'],

alpha=0.2)

p1 = plt.Rectangle((0, 0), 1, 1, fc="white")

p2 = plt.Rectangle((0, 0), 1, 1, fc="grey", alpha=0.3)

ax.legend([lines, p1, p2], ["Predicted inflation",

"In-sample one-step-ahead predictions",

"Out-of-sample forecasts"], loc='upper left')

ax.yaxis.grid()

And we can produce impulse responses.

# Construct the impulse responses

inf_irfs = inf_results.impulse_responses(steps=10)

print(inf_irfs)

0 1.000000

1 0.344649

2 0.337211

3 0.329933

4 0.322812

5 0.315845

6 0.309028

7 0.302358

8 0.295832

9 0.289447

10 0.283200

Name: CPIAUCNS, dtype: float64

ARMA(1, 1) in Statsmodels via SARIMAX

The large class of seasonal autoregressive integrated moving average models - SARIMAX(p, d, q)x(P, D, Q, S) - is implemented in Statsmodels in the sm.tsa.SARIMAX class.

First, we’ll check that fitting an ARMA(1, 1) model by maximum likelihood using sm.tsa.SARIMAX gives the same results as our ARMA11 class, above.

inf_model2 = sm.tsa.SARIMAX(inf, order=(1, 0, 1))

inf_results2 = inf_model2.fit()

print(inf_results2.summary())

Statespace Model Results

==============================================================================

Dep. Variable: CPIAUCNS No. Observations: 183

Model: SARIMAX(1, 0, 1) Log Likelihood -432.375

Date: Sat, 28 Jan 2017 AIC 870.750

Time: 09:42:59 BIC 880.379

Sample: 04-01-1971 HQIC 874.653

- 10-01-2016

Covariance Type: opg

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

ar.L1 0.9784 0.016 62.707 0.000 0.948 1.009

ma.L1 -0.6337 0.059 -10.749 0.000 -0.749 -0.518

sigma2 6.5408 0.342 19.145 0.000 5.871 7.210

===================================================================================

Ljung-Box (Q): 258.38 Jarque-Bera (JB): 653.30

Prob(Q): 0.00 Prob(JB): 0.00

Heteroskedasticity (H): 1.77 Skew: -1.48

Prob(H) (two-sided): 0.03 Kurtosis: 11.77

===================================================================================

Warnings:

[1] Covariance matrix calculated using the outer product of gradients (complex-step).

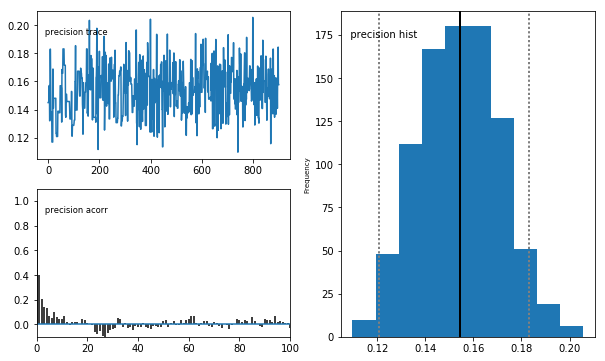

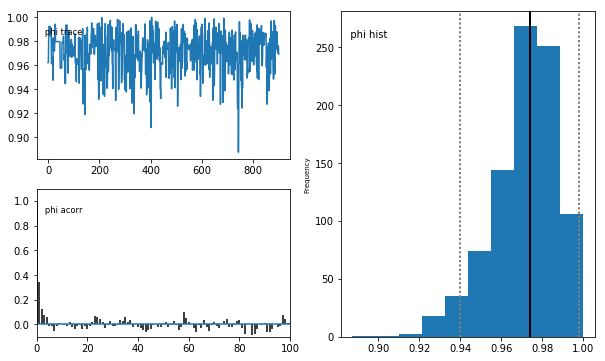

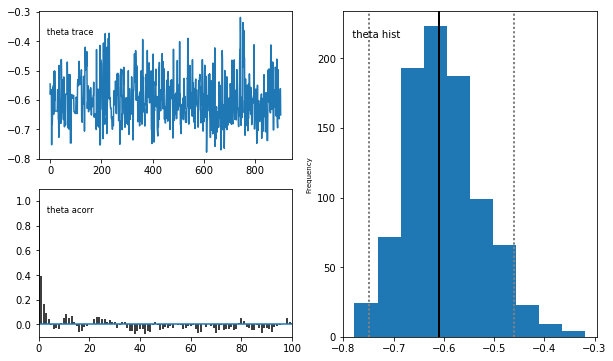

Metropolis-Hastings - ARMA(1, 1)

Here we show how to estimate the ARMA(1, 1) model via Metropolis-Hastings using PyMC. Recall that the ARMA(1, 1) model has three parameters: $(\phi, \theta, \sigma^2)$.

For $\phi$ and $\theta$ we specify uniform priors of $(-1, 1)$, and for $1 / \sigma^2$ we specify a $\Gamma(2, 4)$ prior.

import pymc as mc

# Priors

prior_phi = mc.Uniform('phi', -1, 1)

prior_theta = mc.Uniform('theta', -1, 1)

prior_precision = mc.Gamma('precision', 2, 4)

# Create the model for likelihood evaluation

model = sm.tsa.SARIMAX(inf, order=(1, 0, 1))

# Create the "data" component (stochastic and observed)

@mc.stochastic(dtype=sm.tsa.statespace.MLEModel, observed=True)

def loglikelihood(value=model, phi=prior_phi, theta=prior_theta, precision=prior_precision):

return value.loglike([phi, theta, 1 / precision])

# Create the PyMC model

pymc_model = mc.Model((prior_phi, prior_theta, prior_precision, loglikelihood))

# Create a PyMC sample and perform sampling

sampler = mc.MCMC(pymc_model)

sampler.sample(iter=10000, burn=1000, thin=10)

[-----------------100%-----------------] 10000 of 10000 complete in 11.7 sec

# Plot traces

mc.Matplot.plot(sampler)

Plotting precision

Plotting phi

Plotting theta

Gibbs Sampling - ARMA(1, 1)

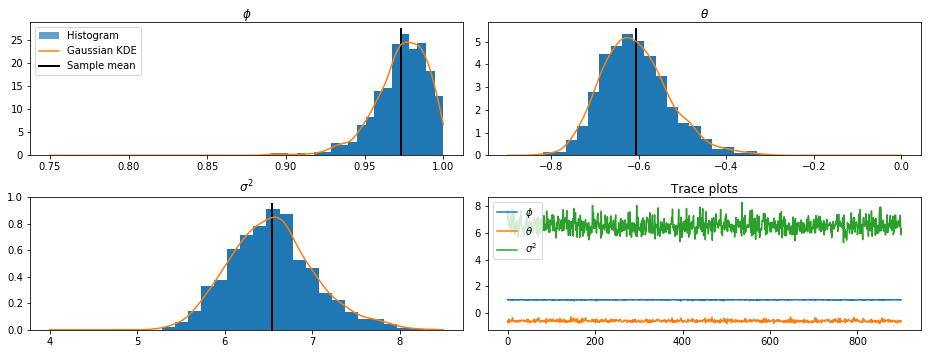

Here we show how to estimate the ARMA(1, 1) model via Metropolis-within-Gibbs Sampling.

from scipy.stats import multivariate_normal, invgamma

def draw_posterior_phi(model, states, sigma2):

Z = states[0:1, 1:]

X = states[0:1, :-1]

tmp = np.linalg.inv(sigma2 * np.eye(1) + np.dot(X, X.T))

post_mean = np.dot(tmp, np.dot(X, Z.T))

post_var = tmp * sigma2

return multivariate_normal(post_mean, post_var).rvs()

def draw_posterior_sigma2(model, states, phi):

resid = states[0, 1:] - phi * states[0, :-1]

post_shape = 3 + model.nobs

post_scale = 3 + np.sum(resid**2)

return invgamma(post_shape, scale=post_scale).rvs()

np.random.seed(17429)

from scipy.stats import norm, uniform

from statsmodels.tsa.statespace.tools import is_invertible

# Create the model for likelihood evaluation and the simulation smoother

model = ARMA11(inf)

sim_smoother = model.simulation_smoother()

# Create the random walk and comparison random variables

rw_proposal = norm(scale=0.3)

# Create storage arrays for the traces

n_iterations = 10000

trace = np.zeros((n_iterations + 1, 3))

trace_accepts = np.zeros(n_iterations)

trace[0] = [0, 0, 1.] # Initial values

# Iterations

for s in range(1, n_iterations + 1):

# 1. Gibbs step: draw the states using the simulation smoother

model.update(trace[s-1], transformed=True)

sim_smoother.simulate()

states = sim_smoother.simulated_state[:, :-1]

# 2. Gibbs step: draw the autoregressive parameters, and apply

# rejection sampling to ensure an invertible lag polynomial

phi = draw_posterior_phi(model, states, trace[s-1, 2])

while not is_invertible([1, -phi]):

phi = draw_posterior_phi(model, states, trace[s-1, 2])

trace[s, 0] = phi

# 3. Gibbs step: draw the variance parameter

sigma2 = draw_posterior_sigma2(model, states, phi)

trace[s, 2] = sigma2

# 4. Metropolis-step for the moving-average parameter

theta = trace[s-1, 1]

proposal = theta + rw_proposal.rvs()

if proposal > -1 and proposal < 1:

acceptance_probability = np.exp(

model.loglike([phi, proposal, sigma2]) -

model.loglike([phi, theta, sigma2]))

if acceptance_probability > uniform.rvs():

theta = proposal

trace_accepts[s-1] = 1

trace[s, 1] = theta

# For analysis, burn the first 1000 observations, and only

# take every tenth remaining observation

burn = 1000

thin = 10

final_trace = trace[burn:][::thin]

from scipy.stats import gaussian_kde

fig, axes = plt.subplots(2, 2, figsize=(13, 5), dpi=300)

phi_kde = gaussian_kde(final_trace[:, 0])

theta_kde = gaussian_kde(final_trace[:, 1])

sigma2_kde = gaussian_kde(final_trace[:, 2])

axes[0, 0].hist(final_trace[:, 0], bins=20, normed=True, alpha=1)

X = np.linspace(0.75, 1.0, 5000)

line, = axes[0, 0].plot(X, phi_kde(X))

ylim = axes[0, 0].get_ylim()

vline = axes[0, 0].vlines(final_trace[:, 0].mean(), ylim[0], ylim[1],

linewidth=2)

axes[0, 0].set(title=r'$\phi$')

axes[0, 1].hist(final_trace[:, 1], bins=20, normed=True, alpha=1)

X = np.linspace(-0.9, 0.0, 5000)

axes[0, 1].plot(X, theta_kde(X))

ylim = axes[0, 1].get_ylim()

vline = axes[0, 1].vlines(final_trace[:, 1].mean(), ylim[0], ylim[1],

linewidth=2)

axes[0, 1].set(title=r'$\theta$')

axes[1, 0].hist(final_trace[:, 2], bins=20, normed=True, alpha=1)

X = np.linspace(4, 8.5, 5000)

axes[1, 0].plot(X, sigma2_kde(X))

ylim = axes[1, 0].get_ylim()

vline = axes[1, 0].vlines(final_trace[:, 2].mean(), ylim[0], ylim[1],

linewidth=2)

axes[1, 0].set(title=r'$\sigma^2$')

p1 = plt.Rectangle((0, 0), 1, 1, alpha=0.7)

axes[0, 0].legend([p1, line, vline],

["Histogram", "Gaussian KDE", "Sample mean"],

loc='upper left')

axes[1, 1].plot(final_trace[:, 0], label=r'$\phi$')

axes[1, 1].plot(final_trace[:, 1], label=r'$\theta$')

axes[1, 1].plot(final_trace[:, 2], label=r'$\sigma^2$')

axes[1, 1].legend(loc='upper left')

axes[1, 1].set(title=r'Trace plots')

fig.tight_layout()

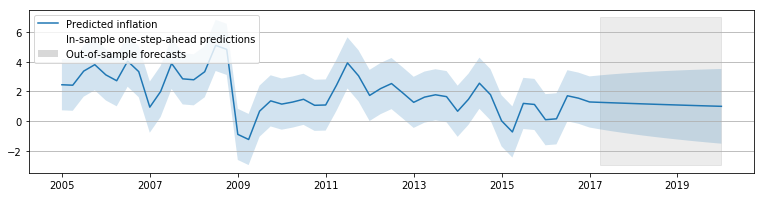

Expanded model: SARIMAX

We’ll try a more complicated model now: SARIMA(3, 0, 0)x(0, 1, 1, 4). The ability to include a seasonal effect is important, since the data series we selected is not seasonally adjusted.

We also add an explanatory “impulse” variable to account for the clear outlier in the fourth quarter of 2008. We’ll estimate this model by maximum likelihood.

outlier_exog = pd.Series(np.zeros(len(inf)), index=inf.index, name='outlier')

outlier_exog['2008-10-01'] = 1

inf_model3 = sm.tsa.SARIMAX(inf, order=(3, 0, 0), seasonal_order=(0, 1, 1, 4), exog=outlier_exog)

inf_results3 = inf_model3.fit()

print(inf_results3.summary())

Statespace Model Results

=========================================================================================

Dep. Variable: CPIAUCNS No. Observations: 183

Model: SARIMAX(3, 0, 0)x(0, 1, 1, 4) Log Likelihood -367.360

Date: Sat, 28 Jan 2017 AIC 746.720

Time: 09:59:04 BIC 765.977

Sample: 04-01-1971 HQIC 754.525

- 10-01-2016

Covariance Type: opg

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

outlier -10.6899 0.777 -13.765 0.000 -12.212 -9.168

ar.L1 0.6547 0.062 10.540 0.000 0.533 0.776

ar.L2 -0.2045 0.075 -2.718 0.007 -0.352 -0.057

ar.L3 0.3774 0.071 5.346 0.000 0.239 0.516

ma.S.L4 -0.8960 0.050 -17.847 0.000 -0.994 -0.798

sigma2 3.4424 0.381 9.029 0.000 2.695 4.190

===================================================================================

Ljung-Box (Q): 32.65 Jarque-Bera (JB): 0.38

Prob(Q): 0.79 Prob(JB): 0.83

Heteroskedasticity (H): 0.85 Skew: -0.10

Prob(H) (two-sided): 0.52 Kurtosis: 2.88

===================================================================================

Warnings:

[1] Covariance matrix calculated using the outer product of gradients (complex-step).

inf_results3.plot_diagnostics(figsize=(13, 5));

In terms of the reported model diagnostics, this model appears to do a better job of explaining the inflation series - although it is far from perfect.

# Construct the predictions / forecasts

# Notice that now to forecast we need to provide an expanded

# outlier_exog series for the new observations

outlier_exog_fcast = np.zeros((13,1))

inf_forecast3 = inf_results3.get_prediction(

start='2005-01-01', end='2020-01-01', exog=outlier_exog_fcast)

# Plot them

fig, ax = plt.subplots(figsize=(13, 3), dpi=300)

forecast = inf_forecast3.predicted_mean

ci = inf_forecast3.conf_int(alpha=0.5)

ax.fill_between(forecast.ix['2017-01-02':].index, -10, 7, color='grey',

alpha=0.15)

lines, = ax.plot(forecast.index, forecast)

ax.fill_between(forecast.index, ci['lower CPIAUCNS'], ci['upper CPIAUCNS'],

alpha=0.2)

p1 = plt.Rectangle((0, 0), 1, 1, fc="white")

p2 = plt.Rectangle((0, 0), 1, 1, fc="grey", alpha=0.3)

ax.legend([lines, p1, p2], ["Predicted inflation",

"In-sample one-step-ahead predictions",

"Out-of-sample forecasts"], loc='lower left')

ax.yaxis.grid()